Bulgarias Euro Dilemma in the Shadow of Croatia and Greece

Novinite.com

12 Jun 2025, 14:45 GMT+10

Introduction

Bulgaria's path toward euro adoption has slowed, with2026 now the earliest realistic entry date. Although the country formally enteredERM II in July 2020, itmissed the 2024 targetand failed to meet inflation benchmarks in 2023. While the Bulgarian government remains committed to joining the eurozone,public opposition has surged, and political resistance is growing.

Notably,President Rumen Radev has called for a national referendum, reflecting widespread skepticism. This article analyzes theeconomic pros and cons, using comparative data fromCroatia,Greece, and other countries that transitioned to the euro.

Bulgaria in 2024: Status Update

Despite technical readiness in areas like fiscal balance and exchange rate stability,inflation volatility and public sentimentare the biggest hurdles.

Public Sentiment: Why Many Bulgarians Oppose the Euro

Recent polls showa majority of Bulgarians are against euro adoption:

Gallup International Balkan (2023):58% opposed, 30% in favor

Trend Research (2023):60?65% againstthe euro in most age groups

Main concerns: Inflation, loss of sovereignty, lack of trust in EU institutions

PresidentRumen Radev, reflecting this sentiment, called for areferendumin 2025. Though no referendum has been held, the idea underscores the political friction surrounding the issue.

Case Study 1: Croatia (Joined Eurozone in 2023)

Context:

Peggedkunato the euro since 1994

GDP per capita (PPP): ?27,200

Inflation (2022): 10.7%

Public debt: 70.6% of GDP

What Happened Post-Euro:

Gains:

Lower interest rates

Boost in tourism revenue(+15% in early 2023)

Improved credit ratings

Full access toECB liquidityand financial safety nets

Problems:

Inflation spike: Prices rose 12.7% YoY in early 2023

Dual pricing confusion: Difficult for elderly and rural populations

Retail backlash: Accusations of price manipulation

Public mistrust: Most Croats opposed euro adoption at the time

Lesson for Bulgaria: Transparent communication and strong consumer protections are essential. Croatia showed that even a ?technically smooth? adoption can create public backlash without careful inflation controls.

Case Study 2: Greece (Joined in 2001)

Context at Entry:

GDP growth: 4.5%

Debt: 103% of GDP (understated)

Unemployment: 10?11%

Inflation: ~3.2%

The Crisis Decade:

Failures:

Underreported deficits and debt

Borrowed heavily due to cheap credit

No control over monetary policy when crisis hit

Deep recession, 27% peak unemployment in 2013

Loss of sovereignty under IMF/EU bailouts

Initial Gains:

Interest rate convergence

Short-term FDI boost

EU structural funds inflows

Lesson for Bulgaria:Sound fiscal governance must be preserved. Unlike Greece, Bulgaria maintains low debt and a conservative budget?but slippage could be catastrophic under euro constraints.

Case Study 3: Other Euro Adopters

These countries demonstrate thatsuccessful euro transitions are possible, but only withpublic trust,price controls, andresilient institutions.

Pros of Euro Adoption for Bulgaria

Economic Advantages:

No conversion costsfor business or tourism

Lower transaction riskwith EU trade partners (~56% of exports to eurozone)

Improved investor confidence(especially in banking and real estate)

Access to ECB's liquidity and safety mechanisms

Enhanced financial credibility

Tighter EU integration, opening door to more cohesion funds and strategic influence

Cons and Risks

Economic and Political Risks:

Loss of monetary tools(no devaluation or independent rate setting)

Perceived inflationdue to rounding-up or pricing abuse

Public resistancemay lead to political instability or delayed adoption

Limited ECB fit?monetary policy might not match Bulgaria's economy

Risk to low-income groups?fixed income households could face real losses

Political tension?referendum calls could polarize society

Conclusion: Is Bulgaria Ready?

Technically: Yes?Bulgaria meets most Maastricht criteria, especially fiscal and exchange rate stability.

Politically: Not yet?public trust is lacking, and euro enthusiasm is far from unanimous.

Economically: Conditional?benefits will materialize only with strong regulatory frameworks and inflation controls.

Final Thought

Euro adoption could anchor Bulgaria more firmly in the EU core, buttiming and trust matter just as much as technical readiness. Learning from Croatia's growing pains and Greece's deeper crisis, Bulgaria must approach 2026 not just as a date?but as atarget for readiness, transparency, and public dialogue.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Switzerland Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Switzerland Times.

More InformationEurope Business

SectionTesla faces EV market pressure as May sales slide in Europe

AMSTERDAM, Netherlands: Tesla saw a sharp decline in sales across several major European markets in May, marking its fifth consecutive...

Mercedes prepares for supply breaks as China delays mineral supply

BERLIN/FRANKFURT: Some car parts factories in Europe have stopped production, and companies like Mercedes-Benz are making backup plans...

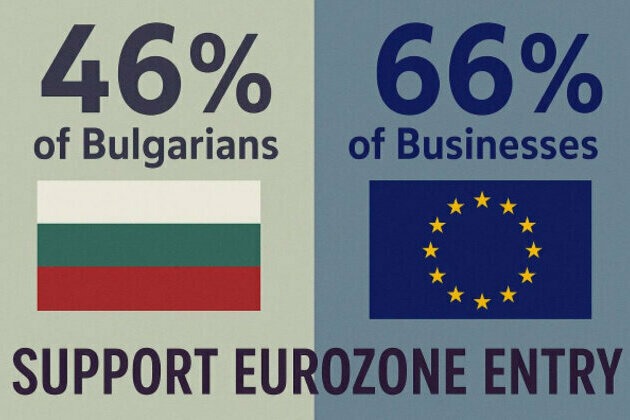

Over 46% of Bulgarians and 66% of Businesses Support Eurozone Entry

Public and business attitudes toward Bulgaria's adoption of the euro were detailed at a briefing hosted by the Ministry of Finance,...

Gold overtakes euro in global reserves

Bullion has gained in prominence as central banks increasingly seek to diversify reserve assets Gold has overtaken the euro to become...

Anti-Euro Protest in Sofia Targets GERB, Media, and State Leadership

A demonstration is taking place in Sofia today, organized by an initiative committee backed by the Revival party. The protest was held...

Bulgarias Euro Dilemma in the Shadow of Croatia and Greece

Introduction Bulgaria's path toward euro adoption has slowed, with2026 now the earliest realistic entry date. Although the country...

International

SectionScores of Israeli planes swarm over Iran in surprise invasion

WEST JERUSALEM, Israel - The Israel Air Force has launched a pre-emptive Pearl Harbour style air raid over Iran, dropping bombs over...

Hundreds of lives lost as London-bound Air India plane crashes after take-off

NEW DELHI, India - The world is in shock following Thursday's devastating plane crash in India which has killed at least 290 people,...

US offers $10 million reward for El Chapo’s fugitive sons

WASHINGTON, D.C.: The United States has placed sanctions on two sons of jailed Mexican drug lord Joaquin El Chapo Guzman. These two...

Author Frederick Forsyth dies at 86 after brief illness

LONDON, UK: Frederick Forsyth, the renowned British author behind The Day of the Jackal and numerous other bestselling thrillers, has...

Storm strands Chinese vessel Near Thitu Island, raises tensions

PUERTO PRINCESA, Philippines: A Chinese ship got stuck in shallow waters near a Philippine-controlled island in the disputed South...

UN Demands End to Myanmar Violence as Junta’s Election Plans Risk Further Instability

Nearly three months after a devastating earthquake struck Myanmar, the country remains trapped in a deepening crisis, compounded by...