Four ways you can financially prepare for a recession

7Newswire

04 Jul 2022, 02:32 GMT+10

Inflation is at a 40-year high. Rates of interest are increasing. Additionally, a gallon of petrol now costs a scary $5.

Investors are being taken on a terrible roller-coaster trip by the stock market. Even if you haven't checked recently, you are aware that your retirement account's value is declining. Unsurprisingly, cryptocurrencies are collapsing.

And now you're hearing that a recession may already be upon us or is unavoidable.

You recall how devastating the Great Recession was for so many people. Therefore, being told to 'cool down' or that 'this too shall pass' won't help you deal with your concern over your financial situation.

That you don't think everything is fine is acceptable.

Making decisions based on recessionary worries, though, might put you in a worse financial situation, so you should avoid doing so.

Recessions are not permanent.

According to Lindsey Bell, chief markets and money strategist at Ally, recessions typically endure 11 months. The 2020 pandemic-induced recession, which lasted only three months, was the shortest recession ever recorded.

Here are seven suggestions to help you stay safe whether or not a recession is on the horizon.

1. Don't be concerned about a bear market.

Even if you have no idea what a bear market is, you are already prepared to be terrified of one.

The S&P 500 index entered a bear market this week, which is indicated by a 20% decline from a recent peak.

Jason Porter, an investment manager at Scottish Heritage SG, estimates that a bear market has lasted on average 418 days since 1950.

If you're a longer-term investor, just adjust your perspective a little and see this as an opportunity, Porter said.

Focus on businesses with solid cash flows, healthy balance sheets, and goods that customers want and need, he advised.

It's a terrific time to use 'dollar-cost averaging,' in which you consistently invest the same amount of money regardless of market ups and downs.

While equities are now suffering losses, traditionally they have recovered well following recessions. You miss the eventual comeback if you don't have exposure to equities.

If you have money to invest right away, Porter advised, it would be wise to see a financial advisor to determine the best long-term dollar-cost averaging method.

2. Avoid attempting to time the market.

Many people might wish to stop investing in the stock market or cut back until conditions improve. That is what it is to attempt to time the market. It's hard to predict when it's best to exit a situation and when it's best to return.

Josh Tyler (Walk Big), claimed that 'the majority of individuals, the majority of ordinary mortals, are not able to time the market.' Warren Buffett would acknowledge that, too.

Stock returns for the S&P 500 often outperform the market until we hit the bear market's bottom point, according to Porter.

3. Pay off whatever credit card debt you have.

Now. Jason Wise, the chief editor at EarthWeb, stated that paying off credit card bills as quickly as possible should be everyone's first priority. It's much more crucial when a recession could be approaching and interest rates are rising quickly.

Taking a low-interest personal loan or applying for a credit card with a balance transfer are two options for dealing with the debt. If you move high-interest debt to a credit card with a 0% APR, you can get out of debt much more quickly.

Wise advised contacting your existing credit provider and requesting an interest rate decrease if you couldn't be approved for a credit card with a 0% interest rate. According to Wise, almost 70% of those who requested one in the previous year received one. But far too few individuals inquire.

4. Build up your savings.

"Because a recession can drastically alter your situation, you should start saving while you still have excess cash.", advises Andrew Gaugler (Best of Machinery)

If you don't have a sizable emergency reserve, you might want to postpone an unnecessary pricey renovation project or cancel a trip.

If you lose your work or find that your income isn't keeping up with historically high inflation, you don't want to be forced to turn to debt. Additionally, keep in mind that the conventional wisdom of keeping three to six months' worth of living costs on hand may not be sufficient.

According to their individual circumstances, workers should appropriately size their emergency reserves.

Younger employees could have greater lifestyle flexibility, allowing them to take on one or more roommates or change careers to take advantage of new job prospects. So that their emergency funds can be closer to the recommended amount of three to six months' worth of living expenditures.

But err on the side of having a year's worth of savings or assets you can quickly sell if you're an older worker who can't alter your living situation or if you're in a highly paid specialised position where replacing your income might take longer if you lose your job.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Switzerland Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Switzerland Times.

More InformationEurope Business

SectionL'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Update: China accepts price undertakings from 34 EU firms in final brandy anti-dumping probe ruling: commerce ministry

BEIJING, July 5 (Xinhua) -- China's Ministry of Commerce said Saturday that it has accepted price undertakings from 34 European Union...

Bulgaria Sees Second-Highest House Price Surge in EU

Bulgaria registered the second-largest increase in housing prices among EU member states in the first quarter of 2025, according to...

EU to propose sanctions on Israel media

Options reportedly include suspending the trade pact, an arms embargo, or sanctions on Israeli ministers, soldiers and settlers The...

EU anxiety over Chinese "trade diversion" proves misguided

BEIJING, July 5 (Xinhua) -- The European Union (EU) is once again casting a wary eye eastward, as alarmist claims of a new China shock...

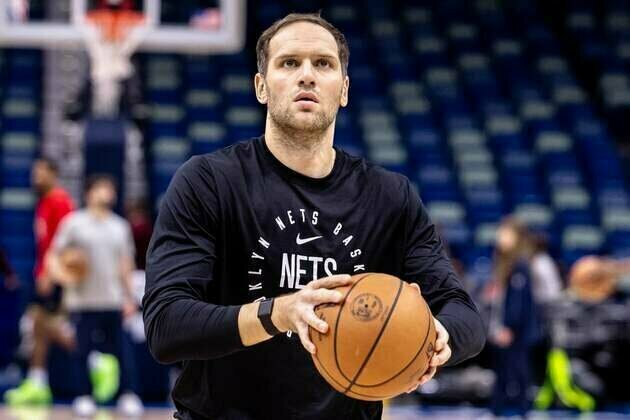

Bojan Bogdanovic retires after 10 NBA seasons

(Photo credit: Stephen Lew-Imagn Images) Bojan Bogdanovic announced his retirement Sunday after 10 NBA seasons with six teams, citing...

International

SectionTragedy in Spain: Diogo Jota and his brother die in car accident

MADRID, Spain: Liverpool footballer Diogo Jota and his younger brother, André Silva, have died in a car accident in Spain. Spanish...

Early heatwave grips Europe, leaving 8 dead and nations on alert

LONDON, U.K.: An unrelenting heatwave sweeping across Europe has pushed early summer temperatures to historic highs, triggering deadly...

U.S. military, China, Russia in Space race

President Donald Trump's plans to build a space-based Golden Dome missile defense shield have drawn immediate criticism from China,...

Trump wins $16 million settlement from Paramount over CBS Harris edit

NEW YORK CITY, New York: Paramount has agreed to pay US$16 million to settle a lawsuit brought by U.S. President Donald Trump over...

British PM faces major party revolt over welfare reforms

LONDON, U.K.: British Prime Minister Keir Starmer won a vote in Parliament this week to move ahead with changes to the country's welfare...

White House meeting between Trump, Netanyahu on July 7

WASHINGTON, D.C.: President Donald Trump will meet Israeli Prime Minister Benjamin Netanyahu at the White House on Monday. President...